![10 Internet Statistics Every Marketer Should Know in 2024 [Infographic]](https://www.oberlo.com/media/1648459115-white-sneaker.png?dpr=0.5)

10 Internet Statistics Every Marketer Should Know in 2024 [Infographic]

[ad_1]

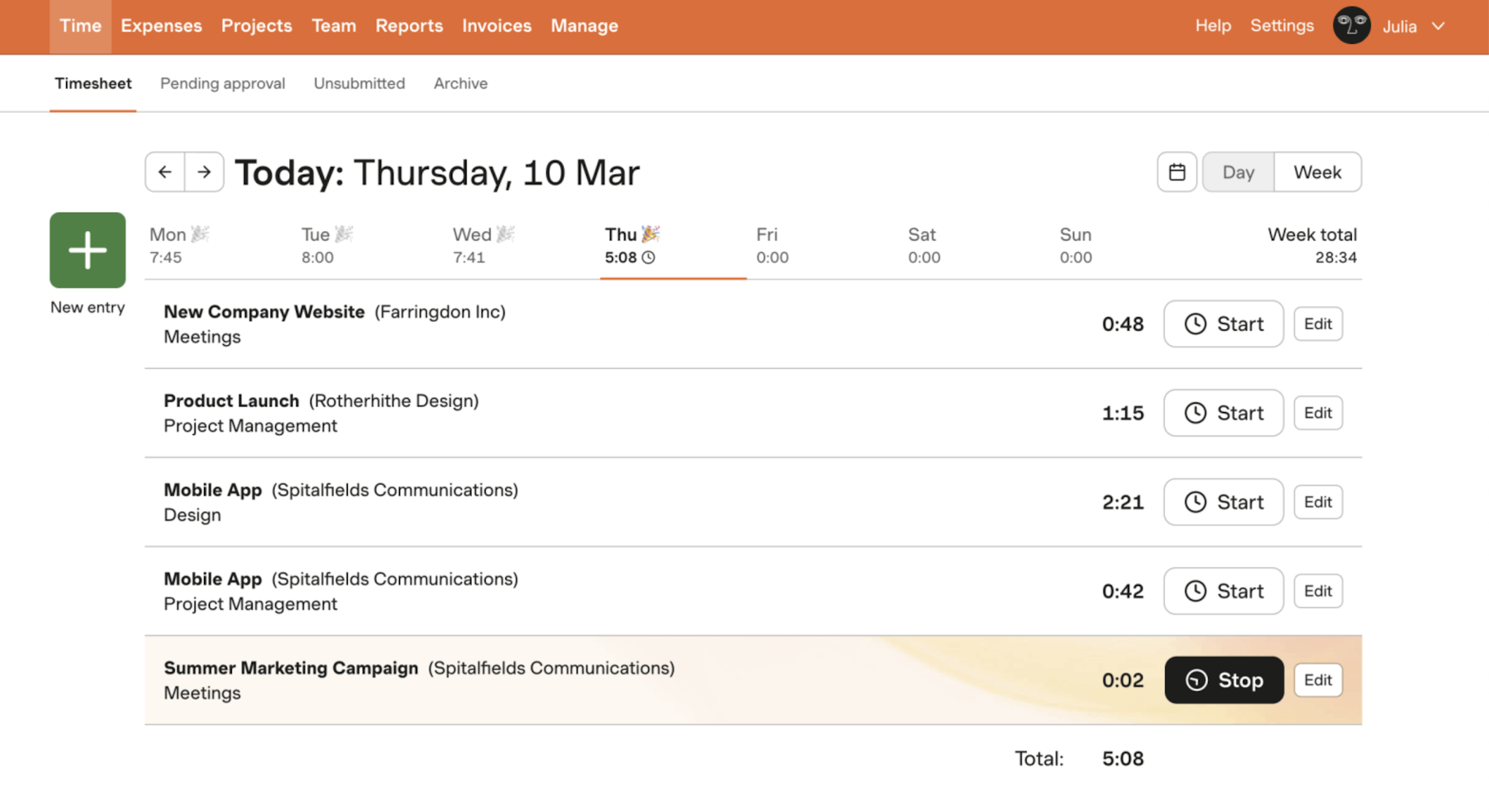

Want to be a part of the booming ecommerce market? Before you begin, it’s important to understand the cornerstone of ecommerce – the internet.

Internet usage statistics will open your eyes to how the ecommerce market works. In this article, we’ll dig into internet statistics and the most commonly asked questions about the internet such as how many people use the internet, how many websites there are, and how much time the average person spends on the internet.

Armed with these internet usage statistics, you’ll get a better idea of what your ecommerce business should be like and is up against so that you know just how to craft your digital marketing strategy.

Enough said. Let’s go straight into the very basics of the internet and take a look at the ten most important internet usage statistics all ecommerce marketers and entrepreneurs must know.

![10 Internet Statistics Every Marketer Should Know in 2024 [Infographic] 1648459115 white sneaker.png?dpr=0](https://www.oberlo.com/media/1648459115-white-sneaker.png?dpr=0.5)

![10 Internet Statistics Every Marketer Should Know in 2024 [Infographic] 1648460220 black sneaker.png?dpr=0](https://www.oberlo.com/media/1648460220-black-sneaker.png?dpr=0.5)

![10 Internet Statistics Every Marketer Should Know in 2024 [Infographic] 1623461337 oberlosketch13](https://www.oberlo.com/media/1623461337-oberlosketch13.png)

1. How Many People Use the Internet?

![10 Internet Statistics Every Marketer Should Know in 2024 [Infographic] internet statistics graphic1](https://www.oberlo.com/media/1702286913-internet-statistics-graphic1.png?w=1824&fit=max)

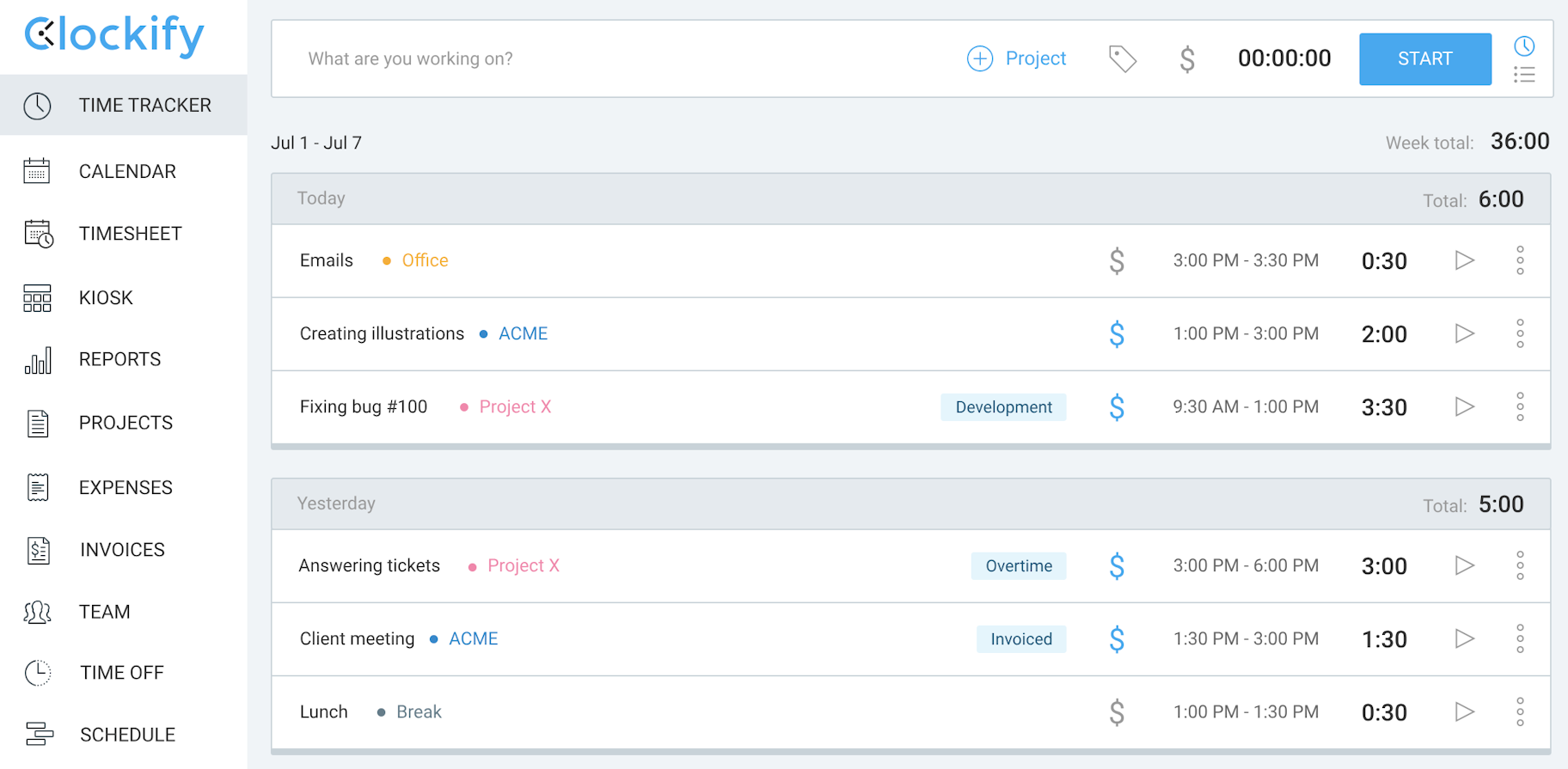

One of the first internet usage statistics you need to know is how many people use the internet.

→ Click Here to Launch Your Online Business with Shopify

As of 2022, there are 4.95 billion active internet users (DataReportal, 2022). That marks a 192 million year-over-year increase compared to 2021’s figures. At four percent, the growth in active internet users worldwide is four times faster than the total population growth, which stands at one percent.

Considering there’s a global population of 7.91 billion people, that equates to an internet penetration rate of approximately 62.6 percent. In other words, nearly two out of every three people worldwide are active internet users.

And with so many things to do online, it’s also important to know other internet usage statistics and more importantly, the top uses of the internet.

Finding information is the most popular activity carried out by internet users: close to six out of every ten internet users browse and search for information online. This is followed by staying in touch with friends and family (54.2 percent), keeping up to date with the latest news and events (50.8 percent), and watching videos, TV shows, and movies (49.8 percent).

2. What Percentage of the World Has Internet Access?

![10 Internet Statistics Every Marketer Should Know in 2024 [Infographic] internet statistics graphic2](https://www.oberlo.com/media/1702286918-internet-statistics-graphic2.png?w=1824&fit=max)

The world has come a long way since the internet was made publicly available in 1991 – more than 30 years ago. Nine years later at the turn of the millennium, 361 million people around the world had access to the internet.

Fast-forward another two decades to today, over six out of every ten, or 65.6 percent, to be exact, of the entire world’s population has internet access (Internet World Stats, 2021).

It should come as no surprise that, as the largest and most populous continent, Asia is home to the majority of global internet users. In fact, nearly one-quarter (24.4 percent) of the world’s internet users are located in East Asia – the region with the largest number of internet users. This is followed by South Asia with 17.7 percent and Southeast Asia with 9.9 percent of the world’s internet users.

Despite the prevalence of internet usage in Asia, it’s Africa that has the fastest-growing online population. Most of the fastest-growing online populations are based in Africa, with the Republic of the Congo leading the charge – as of January 2020, the number of internet users in the country grew 126 percent year-over-year.

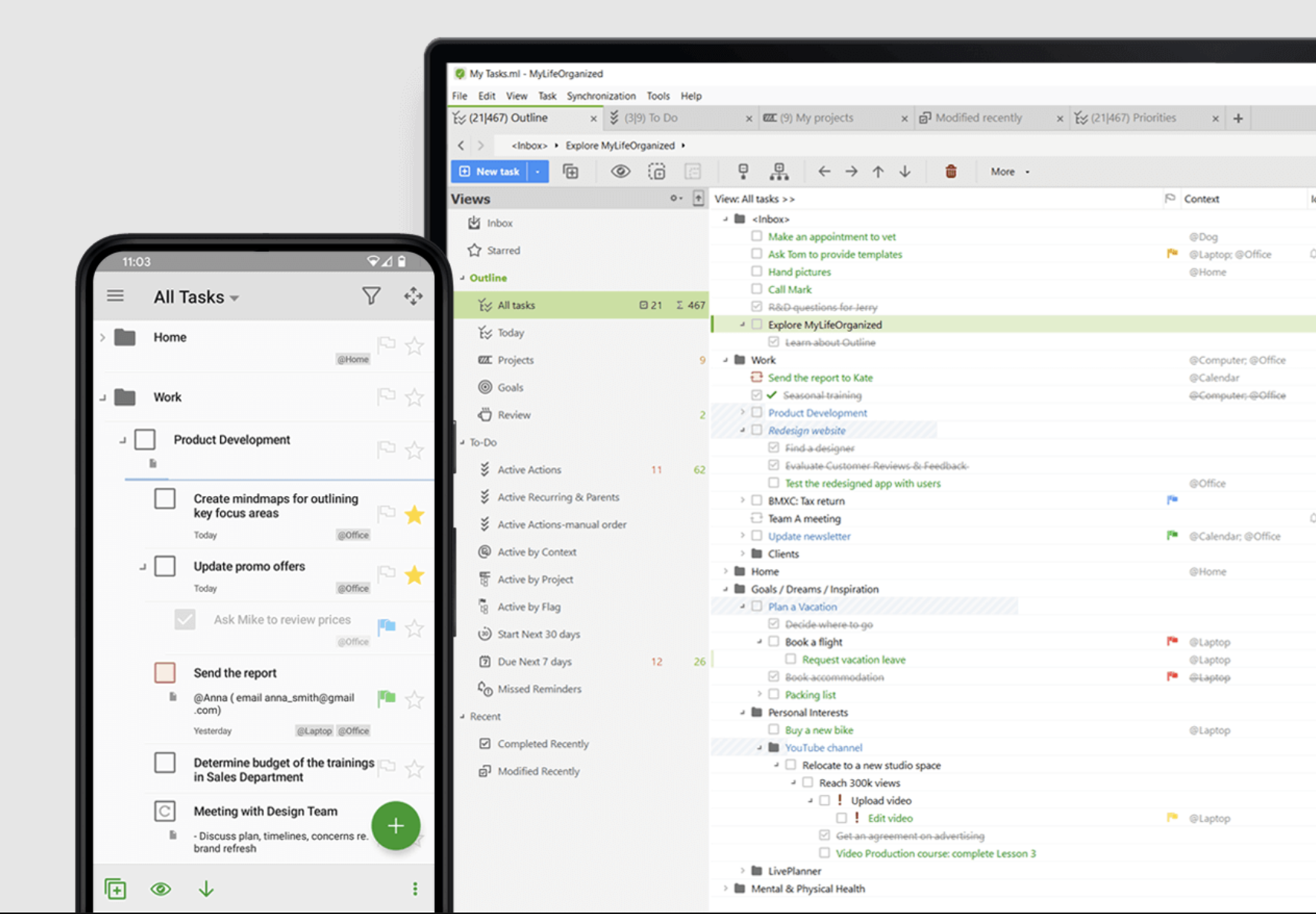

3. Number of Mobile Internet Users Worldwide

![10 Internet Statistics Every Marketer Should Know in 2024 [Infographic] internet statistics graphic3](https://www.oberlo.com/media/1702286922-internet-statistics-graphic3.png?w=1824&fit=max)

There are currently 4.28 billion unique mobile internet users worldwide, representing around 54.6 percent of the global population (Statista, 2020).

That means that out of the 5.2 billion mobile phone owners in the world, more than eight in ten use their phones to access the internet.

In fact, mobile phones are the most popular device with which users access the internet – 50.2 percent of overall web traffic comes through mobile phones. That’s even more than laptops and computers (47.1 percent) and tablet devices (2.6 percent) combined.

And it probably wouldn’t be surprising if the number of mobile internet users continues to grow. This is especially likely because of the increasing speeds of mobile internet connections, which increased by 22 percent from 2019 to 2020.

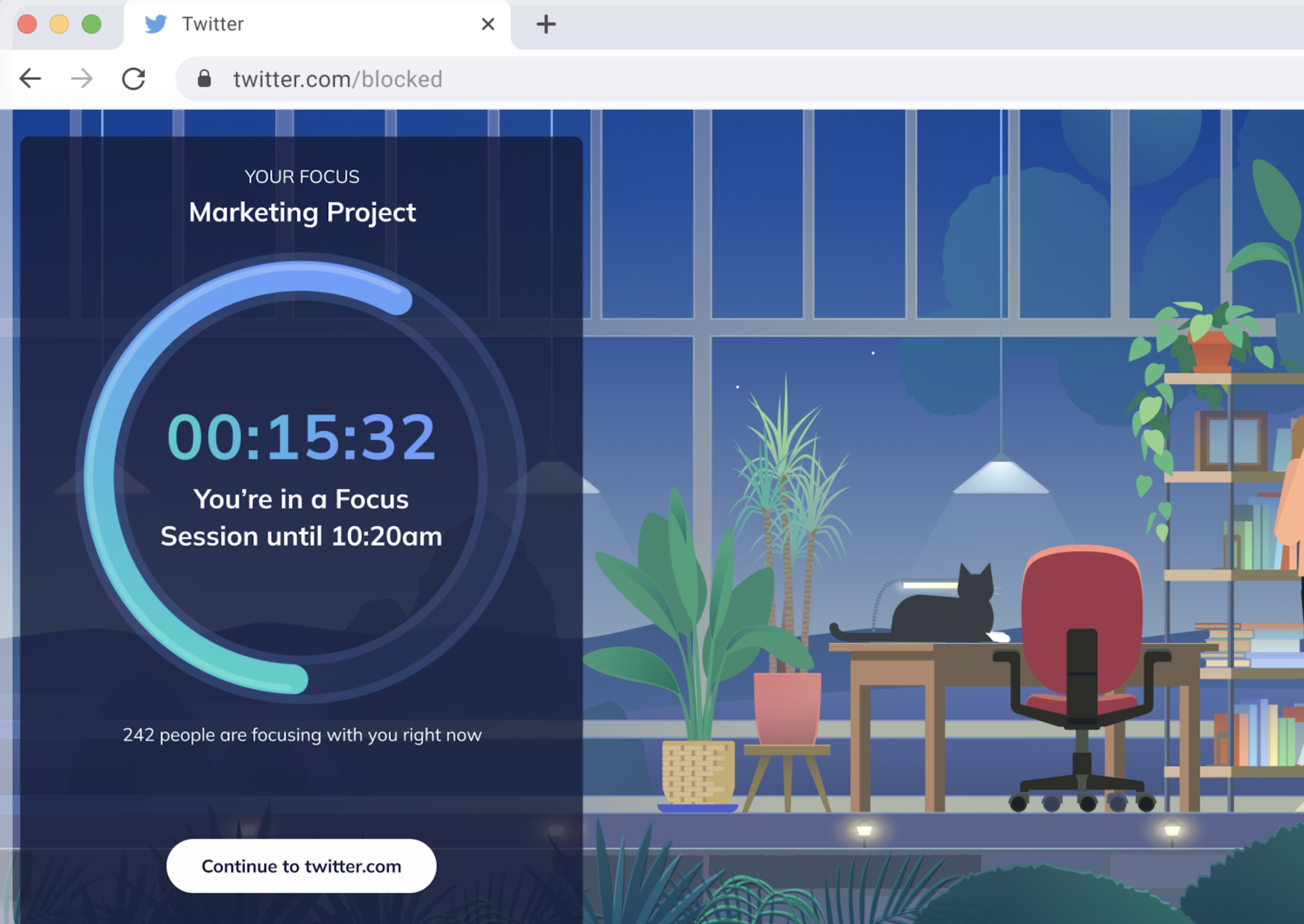

4. How Much Time Does the Average Person Spend on the Internet?

![10 Internet Statistics Every Marketer Should Know in 2024 [Infographic] internet statistics graphic4](https://www.oberlo.com/media/1702286929-internet-statistics-graphic4.png?w=1824&fit=max)

Given that there are so many things to do online, the next internet usage statistic shouldn’t surprise many – on average, internet users spend 6 hours and 56 minutes online each day (DataReportal, 2021).

As an ecommerce business owner, you may be interested to know just how internet users are spending their time on ecommerce activities online.

The latest figures show that 92.2 percent of internet users visit online stores, 81.8 percent carry out online searches for a product or service to purchase, and 78.6 percent follow through with their purchases.

Online shopping and browsing aside, social media is also where internet users spend a large bulk of their time. In fact, the average person spends two hours and 22 minutes a day on social media, with most of this time spent on Facebook and TikTok.

5. Internet Usage Statistics in China

![10 Internet Statistics Every Marketer Should Know in 2024 [Infographic] internet statistics graphic5](https://www.oberlo.com/media/1702286934-internet-statistics-graphic5.png?w=1824&fit=max)

With Asia home to more than half of the internet users worldwide, let’s take a look at the breakdown of internet usage statistics in the continent’s most populous country – China.

Not only is China a major player in ecommerce sales, but it is also the country with the highest number of internet users in the world, home to 1.01 billion internet users (Internet World Stats, 2019). That’s approximately 70 percent of its total population of 1.45 billion and represents more than one-third of all internet users in Asia.

This is impressive growth for China, which, back in 2000, had just 22.5 million internet users. In other words, the number of internet users in China has multiplied nearly 45 times in just over two decades.

6. Internet Usage Statistics in the United States

![10 Internet Statistics Every Marketer Should Know in 2024 [Infographic] internet statistics graphic6](https://www.oberlo.com/media/1702286941-internet-statistics-graphic6.png?w=1824&fit=max)

Whether it’s texting, sending emails, checking the latest movie reviews, looking for products to buy online, or simply browsing, it’s clear that the internet plays a pivotal role in consumers’ daily activities.

This is so much so that as of 2023, more than nine in ten people (91.8 percent) in the United States are internet users (DataReportal, 2023). This is 0.5 percent higher than the previous year’s numbers.

Having a mobile internet connection appears to be one of the biggest (if not the biggest) determining factors of whether US consumers go online. 90.7 percent of Americans go online using mobile phones.

If your online store’s target buyer demographic includes US shoppers, you’ll need to also know what’s attracting them to go online and how much time they spend doing so. The latest data shows the main reason US consumers go online is to find information and that the average consumer spends nearly seven hours a day online.

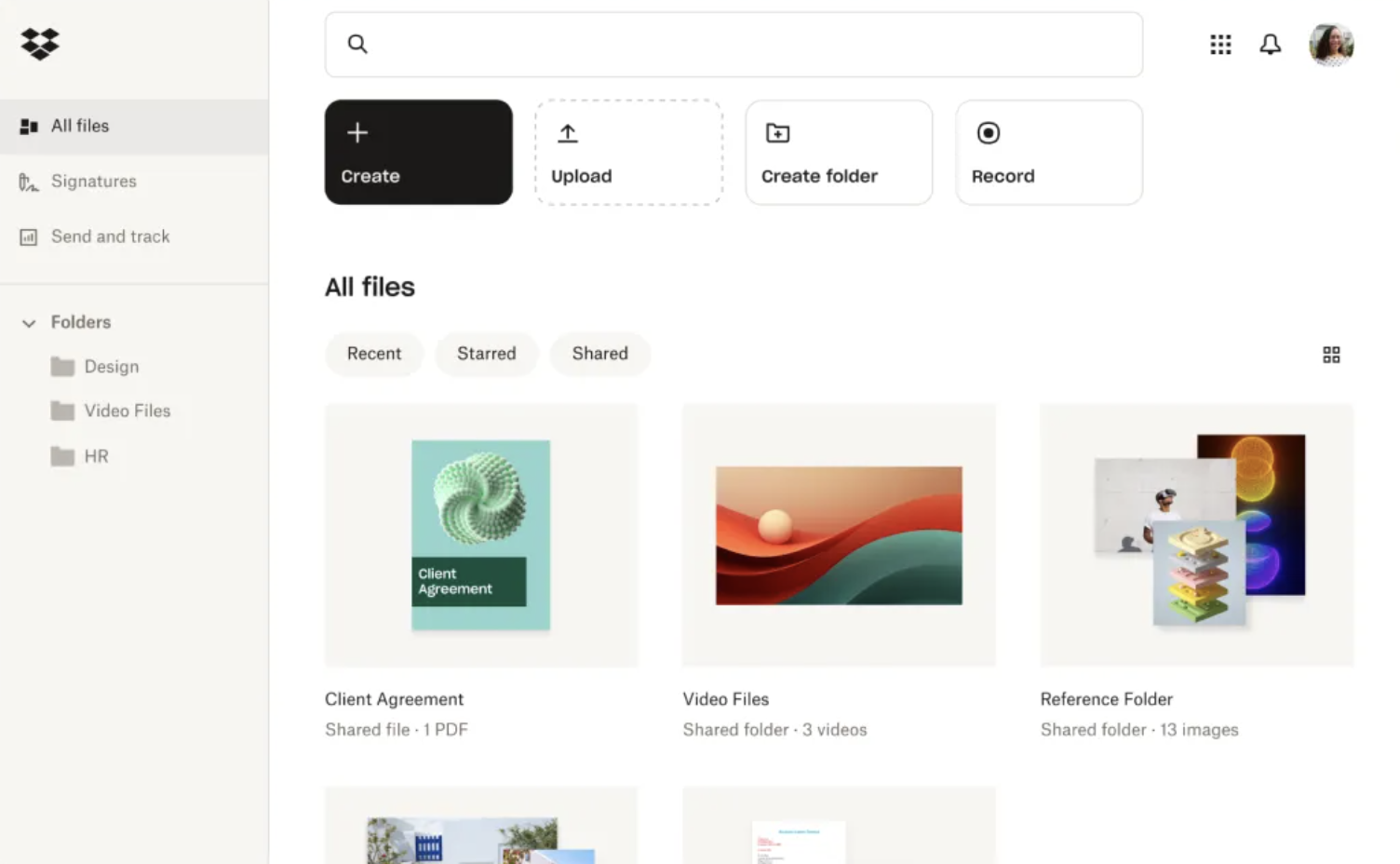

7. Google Chrome Is the Leading Mobile Internet Browser

![10 Internet Statistics Every Marketer Should Know in 2024 [Infographic] internet statistics graphic7](https://www.oberlo.com/media/1702286946-internet-statistics-graphic7.png?w=1824&fit=max)

Google Chrome browser is the leader in the mobile internet browser market, with a share of 64.52 percent (StatCounter Global Stats, 2023).

The market dominance of Google Chrome is somewhat expected, considering nearly three out of every four mobile phones worldwide run on Android and Google Chrome comes pre-installed on most Android phones and tablets.

Google Chrome’s mobile internet browser market share is more than two times that of second-placed Apple’s Safari, which has a market share of 25.19 percent.

The numbers are evidence of Google Chrome and Safari’s firm grip on the mobile internet browser market. To put their dominance into perspective, consider this internet statistic: nearly nine out of ten (89.71 percent) mobile internet users browse with either Chrome or Safari.

But before launching into mobile marketing on Google Chrome for your ecommerce business, it’s important to consider your target audience and market. For instance, Safari is actually the leading mobile internet browser in the United States. It has a market share of 52.68 percent in comparison with Google Chrome’s 40.22 percent.

8. How Many Websites Are There?

![10 Internet Statistics Every Marketer Should Know in 2024 [Infographic] internet statistics graphic8](https://www.oberlo.com/media/1702286951-internet-statistics-graphic8.png?w=1824&fit=max)

The very first website was launched in August 1991, by none other than Tim Berners-Lee, the creator of the worldwide web himself.

The number of websites has been rising ever since, with the worldwide web adding thousands of new websites in its initial years, before ballooning to millions of new websites added annually even before 2000.

Today, it appears everyone’s looking to get in on online opportunities, as the number of domain name registrations continues to rise. Currently, there are over 1.8 billion websites on the world wide web and counting (Internet Live Stats, 2021).

This leads us to the next question: what are the most popular domain name registrations and where are these sites being hosted?

9. Domain Name Registrations

![10 Internet Statistics Every Marketer Should Know in 2024 [Infographic] internet statistics graphic9](https://www.oberlo.com/media/1702286956-internet-statistics-graphic9.png?w=1824&fit=max)

As of the third quarter of 2023, there are 359.3 million domain names registered (DNIB, 2023). This marks a 0.8 percent increase from the previous quarter and a 2.4 percent year-over-year growth.

Domain names ending in .com and .net are especially popular, making up 173.9 million (or 48.4 percent) of all registrations. Of these, nearly all (160.8 million) are .com registrations.

Home to the largest group of internet users, there are 2.3 million registrations on China’s .cn domain. In fact, .cn leads the list of the most popular country-code domain names. Germany’s .de ranks close behind with 17.6 million registrations and the United Kingdom’s .uk rounds out the top three, with 10.9 million.

Where do you go to register a domain? Internet statistics show the two most popular domain name registrars are GoDaddy.com and NameCheap, which hold 11.8 percent and 2.8 percent of the market share, respectively. Breaking this down, we see that there are more than 83.5 million domain names registered on GoDaddy and 19.9 million on NameCheap.

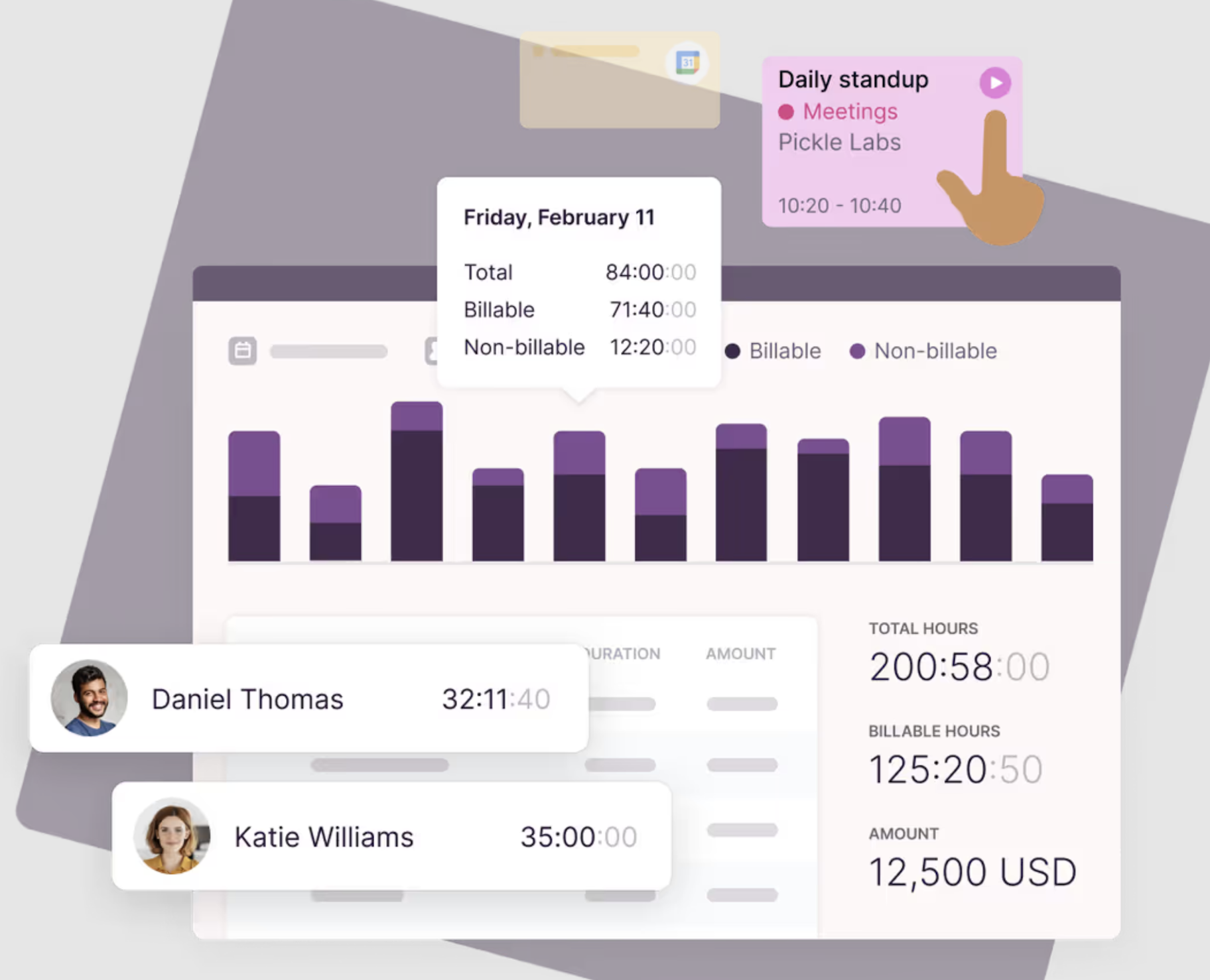

10. Impact of the Internet on Ecommerce Growth

![10 Internet Statistics Every Marketer Should Know in 2024 [Infographic] internet-statistics-graphic10](https://www.oberlo.com/media/1667811416-internet-statistics-graphic10.png?w=1824&fit=max)

Revenues from ecommerce retail were projected to hit $5.7 trillion in 2022 – a 9.7 percent increase from 2021 (eMarketer, 2022). That’s not all. Ecommerce sales are expected to continue rising and exceed $8.1 trillion by 2026.

As the country with the most internet users, China is also the world’s top ecommerce market. The Asian giant was expected to bring in $1.5 trillion in ecommerce sales in 2022, nearly double that of its closest rival, the United States, which is expected to generate $875 billion in ecommerce sales.

Not only has the internet brought about significant ecommerce growth, but the online potential has also spurred ecommerce businesses to increase their digital marketing expenditure.

Expenditure on digital ads worldwide was also expected to reach $602.25 billion in 2022, a 15.6 percent increase from the previous year. This is expected to continue growing and eventually hit $876.1 billion by 2026.

Conclusion

With so many internet users spread across all corners of the globe, the internet is truly a goldmine of opportunities for ecommerce business owners.

Hopefully, these eye-opening internet statistics will be useful to you.

Now that you’re equipped with some of the most important internet usage statistics, you’re ready to take the next step in your digital marketing plan. Be it email marketing or social media marketing, as long as you keep these internet statistics in mind, you’ll be on the right path.

![10 Internet Statistics Every Marketer Should Know in 2024 [Infographic] 1702313743 internet statistics full graphic](https://www.oberlo.com/media/1702313743-internet-statistics-full-graphic.png?w=1824&fit=max)

Summary: Internet Statistics

Here’s a summary of the Internet Statistics for 2024:

- There are currently 4.95 billion active internet users worldwide.

- 65.6 percent of the entire world’s population has internet access.

- There are 4.28 billion unique mobile internet users worldwide, which makes up 54.6 percent of the global population.

- Internet users spend an average of 6 hours and 56 minutes online every day.

- Home to 1.01 billion netizens, China is the country with the highest number of internet users.

- More than nine in 10 people in the US are internet users.

- With a 64.52 percent market share, Google Chrome is the leading mobile internet browser.

- Today, there are over 1.8 billion websites on the world wide web.

- As of the third quarter of 2023, there are 359.3 million domain names registered.

- Revenues from ecommerce retail are projected to hit $8.1 trillion in 2026.

![10 Internet Statistics Every Marketer Should Know in 2024 [Infographic] 1648459115 white sneaker.png?dpr=0](https://www.oberlo.com/media/1648459115-white-sneaker.png?dpr=0.5)

![10 Internet Statistics Every Marketer Should Know in 2024 [Infographic] 1648460220 black sneaker.png?dpr=0](https://www.oberlo.com/media/1648460220-black-sneaker.png?dpr=0.5)

![10 Internet Statistics Every Marketer Should Know in 2024 [Infographic] 1623461337 oberlosketch13](https://www.oberlo.com/media/1623461337-oberlosketch13.png)

Want to Learn More?

Is there anything else you’d like to know about internet statistics and wish was included in this article? Let us know in the comments below!

[ad_2]

Source link

![10 Powerful Podcast Statistics You Need to Know in 2024 [Infographic] podcast statistics graphic1](https://www.oberlo.com/media/1702288308-podcast-statistics-graphic1.png?w=1824&fit=max)

![10 Powerful Podcast Statistics You Need to Know in 2024 [Infographic] podcast statistics graphic2](https://www.oberlo.com/media/1702288313-podcast-statistics-graphic2.png?w=1824&fit=max)

![10 Powerful Podcast Statistics You Need to Know in 2024 [Infographic] podcast statistics graphic3](https://www.oberlo.com/media/1702288317-podcast-statistics-graphic3.png?w=1824&fit=max)

![10 Powerful Podcast Statistics You Need to Know in 2024 [Infographic] podcast statistics graphic4](https://www.oberlo.com/media/1702288322-podcast-statistics-graphic4.png?w=1824&fit=max)

![10 Powerful Podcast Statistics You Need to Know in 2024 [Infographic] podcast statistics graphic5](https://www.oberlo.com/media/1702288326-podcast-statistics-graphic5.png?w=1824&fit=max)

![10 Powerful Podcast Statistics You Need to Know in 2024 [Infographic] podcast statistics graphic6](https://www.oberlo.com/media/1702288330-podcast-statistics-graphic6.png?w=1824&fit=max)

![10 Powerful Podcast Statistics You Need to Know in 2024 [Infographic] podcast statistics graphic7](https://www.oberlo.com/media/1702288334-podcast-statistics-graphic7.png?w=1824&fit=max)

![10 Powerful Podcast Statistics You Need to Know in 2024 [Infographic] podcast statistics graphic8](https://www.oberlo.com/media/1702288338-podcast-statistics-graphic8.png?w=1824&fit=max)

![10 Powerful Podcast Statistics You Need to Know in 2024 [Infographic] podcast statistics graphic9](https://www.oberlo.com/media/1702288341-podcast-statistics-graphic9.png?w=1824&fit=max)

![10 Powerful Podcast Statistics You Need to Know in 2024 [Infographic] podcast statistics graphic10](https://www.oberlo.com/media/1702288347-podcast-statistics-graphic10.png?w=1824&fit=max)

![10 Powerful Podcast Statistics You Need to Know in 2024 [Infographic] podcast statistics full graphic](https://www.oberlo.com/media/1702288300-podcast-statistics-full-graphic.png?w=1824&fit=max)